Double-entry bookkeeping is an accounting method where every financial transaction is recorded in at least two accounts, ensuring that the total debits equal the total credits. It allows for accurate and reliable financial reporting, providing a clear picture of a company’s financial health by maintaining the balance of the accounting equation. This way, every time a transaction occurs, the correct debit and credit balances are posted to corresponding Ledger accounts entirely on their own. Debits and credits help maintain balance in financial transactions through the double-entry bookkeeping system. Every transaction involves a debit and a credit, ensuring that the total debits equal the total credits. The purpose of using credits and debits in accounting is to facilitate accurate and systematic record-keeping of financial transactions.

Related Posts

I’m sharing tales from the trenches of over a decade of finance and accounting experience from Fortune 100 companies to spirited startups. Alright, let’s roll up our sleeves and make double-entry accounting feel as simple understanding taxes on life insurance premiums as a Sunday morning. We’re going to walk through this step-by-step, so you can see exactly how it’s done with real-world scenarios. Revenue and expenses track your earnings and what you spend to earn those revenues.

How to do a balance sheet

This 14-question quiz is a fast way to assess your understanding of the Debits and Credits Explanation. If you use credit cards, check the card issuer website frequently to review your activity. Keep an eye out for fraudulent charges and make all of your payments on time. Fortunately, federal governments have put stronger consumer protection laws in place to protect cardholders. The majority of activity in the revenue category is sales to customers.

- You pay monthly fees, plus interest, on anything that you borrow.

- This graded 20-question test measures your understanding of the topic Debits and Credits.

- Debits represent a company’s funds on hand, while credits represent the funds it owes.

- After you make an invoice, the corresponding debit and credit entries are added by the system to Accounts Receivable, Sales, Cash, and so on.

- Perhaps you need help balancing your credits and debits on your income statement.

- In financial accounting, there are rules set in place that ensure that every financial transaction has equal amounts of debits and credits.

Debits and credits chart

These technologies are not just buzzwords; they’re transforming the way we handle financial data. This graded 30-question test provides coaching to guide you to the correct answers. Use our coaching to learn the WHY behind each answer and deepen your understanding of the topic Debits and Credits. Let’s go through a detailed example to understand how credits work. Let’s go through a detailed example to understand how debits work. The company purchases $500 of supplies from a vendor and receives an invoice, but doesn’t pay the invoice yet.

Income or Revenue Account

The balance sheet can be used to assess a company’s financial health, identify trends over time, and compare its performance to that of its peers. For small businesses, the balance sheet can be particularly useful in understanding where they stand financially and making informed decisions about their future. The balance sheet is one of the most important financial reports for any business, large or small. It provides a snapshot of a company’s assets, liabilities, and equity account at a given point in time.

Q5. Can a single transaction involve both a debit and a credit entry?

Credit balances go to the right of a journal entry, with debit balances going to the left. This information will be essential as you begin navigating the business world. Are you interested in learning more about debits and credits? Check out our blog post on why debits and credits are essential in accounting. The red shows a decrease in assets and expenses but an increase in liabilities, capital and income. The liability account on a company’s balance sheet includes all of the money that the company owes.

The term losses is also used to report the writedown of asset amounts to amounts less than cost. It is also used to refer to several periods of net losses caused by expenses exceeding revenues. Gains result from the sale of an asset (other than inventory). A gain is measured by the proceeds from the sale minus the amount shown on the company’s books. Since the gain is outside of the main activity of a business, it is reported as a nonoperating or other revenue on the company’s income statement. Let’s make this accounting stuff real with some practical examples.

Keep reading through or use the jump-to links below to jump to a section of interest. Sal purchases a $1,000 piece of equipment, paying half of the purchase price immediately and signing a promissory note for the remaining balance. Sal’s journal entry would debit the Fixed Asset account for $1,000, credit the Cash account for $500, and credit Notes Payable for $500. Sal’s Surfboards sells 3 surfboards to a customer for $1,000. Sal deposits the money directly into his company’s business account.

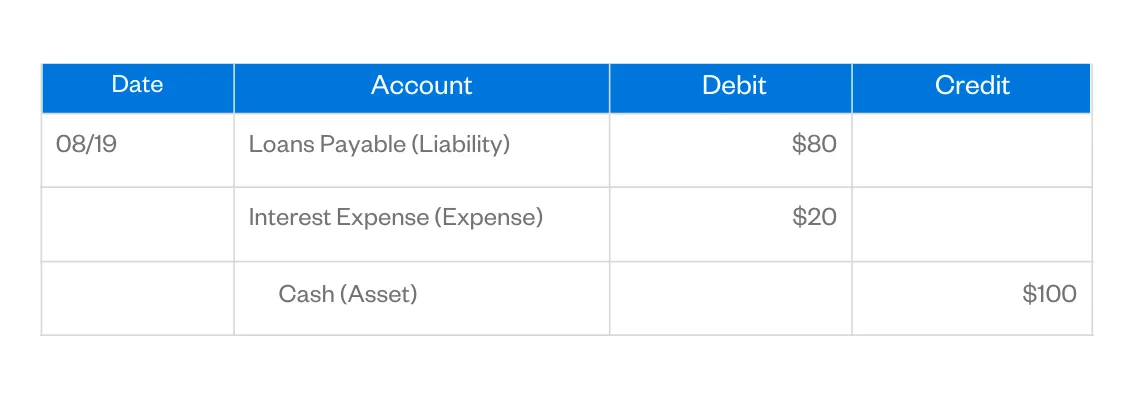

You’ll pay interest charges for both forms of credit, and borrowing money impacts your business credit history. Again, equal but opposite means if you increase one account, you need to decrease the other account and vice versa. The company pays an outstanding vendor invoice of $500 that was previously recorded as an expense. The company makes a cash sale of inventory to a customer for $100. This represents consumable items used in the business’s day-to-day operations, such as office or cleaning supplies.

Debits and credits are used in a company’s bookkeeping in order for its books to balance. Debits increase asset or expense accounts and decrease liability, revenue or equity accounts. When recording a transaction, every debit entry must have a corresponding credit entry for the same dollar amount, or vice-versa. In accounting, credits, and debits are fundamental principles of the double-entry bookkeeping system. Since assets are on the left side of the equation, an asset account increases with a debit entry and decreases with a credit entry. Conversely, liabilities are on the right side of the equation, so they are increased by credits and decreased by debits.